What does getting prequalified for a home loan mean and how hard is it to do?

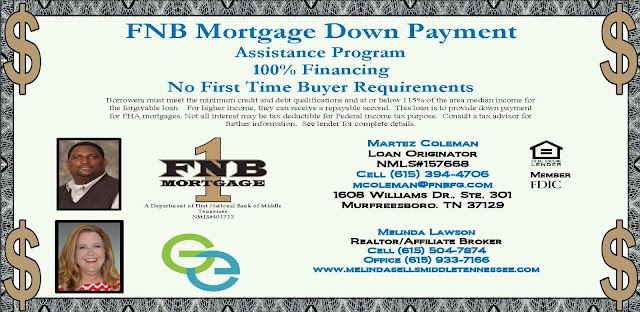

GETTING PREQUALIFIED GETTING PREQUALIFIED Why do you need to get prequalified? It is very important in today’s market to get prequalified with a lender of your choosing. I have lenders that I can recommend to you but it is your choice who you decide to work with. Getting prequalified helps you determine your budget on what you want and can afford. You don’t want to be looking at $400,000 homes to find out the payment you want is on a $250,000 home, as well you don’t want to be looking at $200,000 homes getting frustrated when your payment budget could have you looking up to $300,000. As well when you do find the home you like the listing agent will require a copy of your preapproval letter.(You don’t want to miss out on the opportunity to make an offer while waiting to get prequalified.) Please watch video below for more information: www.melindasellsmiddletennessee.com